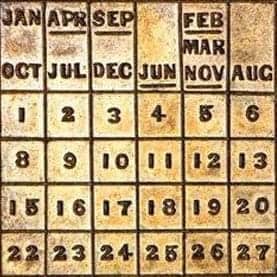

September 4-12, 2009: The Long Beach Coin & Currency Expo

September 3rd: Prologue

This is when it is really fun for us.

No, not the getting up early, packing our suitcases for the umpteenth time this year, saying so long to the family or schlepping across the country once again. That’s not fun.

But when we get to California, it’s veritable coin-geek heaven, as we get to hang out with a lot of good numismatic friends, view some amazing Naftzger and Dan Holmes coins at Goldbergs, and then bid like a drunken-sailor once the live sessions begin.

An activity we are so ‘into’, that if we were not CRO, and we were not in the business, we’d be out there anyway.

Which is why we feel so lucky to be doing what we do, and are so glad to be able to write about it here in the Road Report.

We’ll be updating this blog daily for the next 9 days, first covering the aforementioned auctions, then moving on down to the show itself (don’t forget the Heritage auctions!) in Long Beach starting on Wednesday.

So you might want to keep an eye out for that.

September 4th: Dave’s Magical Journey

With John holding down the numismatic fort in New England this weekend, your author (David J. Wnuck) will be representing team CRO at the Beverly Hills Auctions, and, more importantly, taking on the important Road Reporting duties for the next several days.

And, whenever this has happened in the past, I have jokingly remarked to John that I hope my days will be filled with exciting (even magical) adventures which I can write about here on our site in a flowery style. And then much jocularity ensues. Though in retrospect, I should have been more careful what I wished for (ominous foreshadowing).

Insomnia

Our story begins like they almost always do on the day I am leaving for a coin show. I was restless the night before and got only a few hours sleep (yes, after a couple of decades of doing this I still get ramped up about it). When I was 12 it was from pure excitement and anticipation. Now it is a combination of that excitement, plus a large adult-sized dose of anxiety. I stress out about whether I’ve paid all the bills, answered all the email and phone messages, shipped out all the orders, packed all the right inventory and supplies and have done everything I was supposed to do before leaving home and office for several days.

And, more often than not, it’s extremely hectic, even when I’m not doing a last minute appraisal for a local antique store (which I was), and it is taking waaaaay longer than I planned (it did).

But certainly that would not be a problem, since an experienced traveler like myself would give himself ample time to get to the airport, and would be traveling by a familiar route taken dozens of times before. Right?

The Brilliantly Conceived Plan

Weeks before this trip, I was expertly arranging my schedule and trying to figure out the most efficient way to fly to California, attend the auctions and the show, and then attend another numismatic event here on the east coast on the way home.

The result of which was that I decided to depart not from my regular airport (which I actually know how to get to), but instead would drive several hours and depart from an airport nowhere near my office (and from which I have not flown in years) since it would be closer to the post-show meeting.

And, as an added bonus, this long drive, and the fact that I would be taking an unfamiliar route AND upsetting my normal travel routine only added to my insomnia last night, resulted in substantial tossing and turning, and included a vivid dream about losing an important coin under an immovable kitchen appliance.

The Shortcut

Whatever great plan I had, and whatever timetable I would be following pretty much immediately went out the window, having been disrupted by a force of nature known as a ‘Black Hole’ (which in this case was, of course, the Cross Bronx Expressway). It was at a standstill, and as I watched the minutes tick away on the clock in my car, I first began impatiently tapping on the wheel, then shouting at no one in particular, before I decided to take matters into my own hands.

Like most guys, I assume I have an innate sense of direction and a knack for finding shortcuts other folks might miss. So what if I didn’t know the area and had no Garmin or map? Unneccessary. Instead, I used various road signs for navigation, took the next exit and headed to a little-known town named ‘New York City’. Perhaps you’ve heard of it. I mean – driving through that little burg on a Friday afternoon on a holiday weekend would surely gain me the time I needed.

A few bridges and tunnels later it still seemed like I had a chance (nope), and I did not fully resign myself to the inevitable fact that I was going to miss my flight (by hours, actually) until I drove by – I kid you not – the Trapeze School of New York, something I have never heard of before despite living in this area for a decade or two. On a more positive note, the school had opened a large door apparently so that people lost on their way to the airport could peer in and see aspiring trapeze artists gracefully twirling, spinning and leaping through the air. Somehow seeing people engaged in this utterly pointless activity (unlike coin collecting) relaxed me, so I took my foot off the gas, called the airline from the car and booked a flight that left 2 hours later.

And I made that one without a hitch and had a genuinely wonderful, relaxing flight.

What does all this travel nonsense have to do with rare coins? Nothing really. Just a window into our world as we glamorously travel the country on our way to see, ho hum, one of the finest and certainly the most complete collection of early date large cents to be sold in our lifetimes.

Which makes all this other stuff worthwhile.

It also means that tomorrow’s RR will include actual numismatic information about the coins and coin dealering, and not so much about the trapeze.

September 5th: Setting the Stage

Without even getting into an automobile, I walked down to Goldberg’s offices on Saturday arriving at 8:15 AM (before it was officially opened) and into a lot viewing room so full that the crowd had spilled out into the waiting area and other offices.

At that point, I realized I had a long day ahead of me.

So I got right to it, digging into the Dan Holmes Collection, Part I catalog and taking whatever boxes in whatever sequence I could get ‘em from the lot viewing assistants.

Room with a View

Now, we had reviewed this catalog many times before today, and we’ve seen a number of these lots at various shows where Goldberg’s / McCawley-Grellman had them on display, and we had a pretty good idea which coins where of high interest to CRO before I got here. But with the entire collection of extremely rare and very cool coins in front of me I had to force myself to focus on the coins we would try to buy and remind myself that I was ‘at work’, and not on some big coin vacation (though my wife would disagree with this, and admittedly the lines get blurred sometimes).

And after several hours of serious viewing, and then a second round reviewing the ones we had on our high interest list, I had narrowed it down to a couple of dozen coins that I liked, including slabbed coins that I thought were accurately graded (which was definitely not all of them), raw coins that I felt confident would grade at certain levels (not so easy with these early federal issues), and came up with a final list of items that we would be chasing.

It’s Only a Game

Much like the mating dance of a large bird on Mutual of Omaha’s Wild Kingdom (sort of), the pre-auction rituals of serious bidders viewing a major collection of rare (and rarely traded) items is predictable, fascinating, and sometimes pretty annoying, as a lot of guys try to influence other bidders, and/or glean top secret information about the lots, about the grades and about the likely bid levels from the competition.

This can range from the casual open ended inquiry “What did you think of lot #xxx?”, to the overt “Hey Dave, how much do you think lot #xxx will sell for?”, to the blatant attempt to scare someone else off with an unsolicited “Did you see the hidden tooling on lot #xxx!” warning, usually announced in a loud voice to no one in partcular.

When I first got into the business years ago this sort of stuff worked on me, with older dealers either hitting me up for information and then using it against me in the auction room, or, worse, intimidating me off of certain lots. Why I remember one prominent example about a dozen years ago when I was warned by another dealer that a particularly rare and high priced coin in an upcoming auction was “An electrotype!” (i.e. a fake, causing me to cross it off my bidding list), and then watched that very same dealer buy it at the auction the next day for a new record price. Hmmmmm.

After that eye-opening experience, I ‘got it’, and now I take all this gamesmanship in stride, ignore the propaganda, focus on our own bidding and, occasionally, per the approach used by my partner John, simply make up ridiculous misleading answers to questions if another dealer gets too pushy.

But with all the viewing done, and gamemanship behind me (I think), it was time for dinner.

The Feast

It’s important to eat a good meal before participating in either a ‘regular’ or numismatic marathon (which tomorrow’s auction will be), and rest assured, I did, at the spectacular cocktail reception held at Larry Goldberg’s beautiful home.

I knew it was going to be quite a shindig when I arrived in our rental car and was greeted by the eight valets they hired (no exaggeration) to park guest’s cars, and I was right.

Great food and great camaraderie, with the highlight of the evening being when Mr. Holmes, accompanied by his lovely wife, spoke to the crowd with some heartfelt words about the coins, about collecting, and about the many friends they had made along the way.

After which all of the attendees received a special hardbound edition of the Holmes catalog, and a DVD describing the collection. How cool is that?

In all, it was a wonderful evening and a world class event, which set the stage very nicely for the actual auction which will take place on Sunday, and which will be described here, in vivid detail, in about 24 hours from now.

September 6th: If You Build it, They Will Come

In a cold auction room (one participant likened it to a meat locker), the market was anything but, with bids on the Dan Holmes Collection coming fast and furious (and really, really high!) from many sources, and by any objective measure, tonight’s session was stronger than any sale of early copper coins has ever been. Ever.

With a few notable results as follows:

Lot #1, a lovely 1793 Chain Cent, AMERI. in AU58 [PCGS] started things off nicely, bringing $368,000 all-in for a coin which last sold for $218,500 in 2004.

Lots #7 and 8, a pair(!) of 1793 Strawberry Leaf Cents (though different die varieties) in F2 [PCGS] and G4 [PCGS] respectively brought a respectable $264,500 and $218,500.

Lot #24, a very high end (for the issue)1793 Liberty Cap Cent, S-14, in AU53 [PCGS] brought a robust $506,000.

Lot #79, a quite attractive and well pedigreed 1794 Starred Reverse Cent in VF30 [PCGS] brought a reasonable sounding $212,750.

Lot #95 an aggressively graded (in my humble opinion) 1794 S-59 Cent in MS66RB [PCGS] brought $276,000.

Lot #128, the finest known Reeded Edge 1795 Large Cent, S-79, in the lofty grade of VG10 [PCGS] went for the shockingly high price of $1,265,000, the most money ever paid by anyone, anywhere, for a large cent. My conclusion: Edge variety collecting is alive and well.

Lot #349, a very pleasing 1799/8 Cent in XF45 [PCGS] frankly stunned me (and I don’t stun that easily) at the amazing price of $368,000. Which made me feel pretty certain that our $400,000 planned bid on lot #352 wasn’t going to be enough . . .

And it wasn’t, as #352, the incredible 1799 Cent graded MS61 [PCGS] (formerly MS62 [NGC] as described in the catalog) with actual cartwheel luster (and absolutely blowing away every other example of this issue I’ve ever seen) ran away and hid at $977,500.

Lot #455, a really beautiful 1802 Cent in MS67 RB [PCGS] landed at $333,500 (compared to a catalog estimate of $50,000+).

Lot #531, another remarkable piece, the finest known 1804 Cent in MS63 BN [PCGS] ran to $661,250 which, at that point, didn’t surprise me at all.

But it wasn’t all serious stuff. Such as when lot #544, an inexpensive 1807 Cent (estimated at “$200 & up”) hit the block. The bidding was proceeding in the usual way until one of Dan Holmes’ family members held up a 2 year-old blonde girl with a bidder card in her hand, her dad clearly intending for her to bid on this coin. When the auctioneer (Ira Goldberg) saw it, he said, “Now who is going to bid against this little one?”. Immediately the other bidders put their cards down and the lot was hammered down to the little girl as the audience laughed in approval.

Lot #544 not withstanding, all of these results were fantastic, but rather than make obtuse comparisons of what similar items brought in recent sales, or how the Holmes sale stacked up against other major auctions of the distant past, I figured it would be interesting to look at the performance of the coins in the Dan Holmes collection that were actually purchased at Heritage’s February 2008 sale of the Husak auction (yes, there were quite a few such pieces).

The Husak sale has generally been considered the absolute peak of the large cent market (and maybe the coin market in general, for that matter), and coming into this session we thought some of these coins would sell for 15 or 20% less this time around (roughly consistent with other price decreases in the overall market).

But this is what we saw Sunday in Beverly Hills:

Lot #18, a 1793 Wreath Cent in AU53 [PCGS] brought $27,600 in the February, 2008 Walter Husak sale; tonight it sold for the exact same $ 27,600. Hmmm, I thought to myself, looks like that one actually held up.

Lot #37, a 1794 S-22 Cent in MS63 BN [PCGS] brought $48,875 in the Husak sale, but reached only $31,050 in this session. At which point I figured we’d see this sort of trend all night – a thought which lasted all of about 15 seconds until the next lot came up.

Lot #38, a 1794 S-23 Cent in MS64 BN [PCGS] brought $66,700 in Husak, but blew right past that in the Holmes sale landing at $106,375. That’s about 60% more than last time for those scoring at home.

Lot #53, the finest known 1794 S-33 ‘Wheelspoke Reverse” Cent described in the catalog as raw VF25 (having been removed from a PCGS 35 holder by the raw coin-preferring Mr. Holmes), brought $103,500 at Husak, but dipped to $94,875 in this sale.

Lot #74, a lovely 1794 S-45 Cent in MS65 RB [PCGS] brought $149,500 at Husak, but reached $184,000 last night.

Lot #87, a 1794 S-54 Cent described as raw VF35 (removed from a PCGS 53 holder) brought $16,100 in Husak, $18,400 this time around.

Lot #99, the finest 1794 S-62 Cent in MS63 BN [PCGS] brought $57,500 in Husak, $86,250 in Holmes.

Lot #108, the 1794 S-66 ‘Split Pole’ Cent in raw VF25 (removed from a PCGS 35 holder) stayed the course, bringing $54,625 at Husak vs $55,200 at Holmes.

Lot #110, a very pretty 1794 S-68 Cent in raw AU55 (removed from a PCGS 58 holder) did not stay the course, having brought $80,500 in Husak, but rocketing to $155,250 in the Holmes sale.

Lot #113. A pleasing 1794 S-70 Cent in MS62 BN [PCGS] went from $32,200 in Husak to $41,400 in Holmes.

Finally, lot #117, a 1795 S-73 Cent in raw VF35+ (removed from a PCGS 45 holder) showed little change, bringing $32,200 in Husak and $32,775 in this session.

So, a couple were lower or flat, but overall (and amazingly) these coins brought well more tonight than they did at what many of us thought was the top of the market.

So what does that mean? Several things to us:

Goldberg’s / McCawley-Grellman put on a spectacular auction (from the catalog to lot viewing to the wonderful treatment of their bidders to the session itself) and delivered exceptional results.

The demand for top notch material (at least in this category) is stronger than it has ever been.

Nothing brings out the bidders like a great collection built over many years with lots of cool stuff in it that hasn’t been seen in years.

It is possible to build a spectacular collection, enjoy the chase, make many friends along the way and do very well financially in the process. Just ask Mr. Holmes.

And what does this mean for the “regular” market of less spectacular coins?

I do not think it means that every 1794 Large Cent, regardless of condition or variety, has now increased in value.

I do think it generates interest in this category and adds excitement to the overall market.

For us, it means we will keep doing exactly what we’ve been doing, which is to try to buy nice coins for prices that make sense to us, starting with the very next Goldberg session (Naftzger, Part III) tomorrow.

But in the meantime, I’m going to bed.

September 7th: RD is the New Black

As in mint red is the new “in color”. Not that it was ever really out of favor, of course, but the degree to which it was being sought by bidders in the Naftzger III sale was frankly astonishing (to me, anyway).

Because that’s not what I thought would happen.

Even though today’s sale contained the greatest collection of late date large cents ever assembled, and one that will never be matched (I don’t think), I personally predicted (quietly, in the privacy of my hotel room and not, for example, plastered all over a chatroom somewhere) that today’s sale would be a little soft(!).

Not because the coins weren’t gorgeous – they were – beautiful, pristine pieces with exceptional color, with most of them conservatively graded (again in my opinion) by PCGS.

I just figured that late date large cents have always played second fiddle to the much more popular early and middle date large cents. This is because they are much more common in nice uncirculated grades than their earlier brethren, and also because the differences in die varieties are very minute and thus a little less interesting to many collectors.

And there was precedence for my prediction. Wes Rasmussen’s entire large cent collection was sold at auction a few years back, a fantastic and nearly complete set by die variety from 1793 through 1857. All the coins were sold in one big session and by the time the late dates came around, the excitement was gone, and so were most of the bidders (along with their money). The few folks left in the auction room that night got some terrific bargains on some of Rasmussen’s wonderful late date pieces.

So, since the record breaking Holmes sale was just last night, and sucked millions of well-documented dollars out of collectors’ and dealers’ wallets, I figured the Naftzger late dates would also go wanting.

I was utterly, totally and completely wrong.

The sale dragged on for hours because nearly every lot had mutliple would-be buyers launching their bidder cards and desperately trying to buy these coins . The buyers saw red – mint red, that is – and the more of it they saw, the more they wanted these coins. Which meant that in a specialty in which five figure price tags had previously been very few and very far between, we saw results like this:

Lot #603, an 1840 N-2 Cent, considered to be Rarity-2, in MS65 RB [PCGS], rocketed to $24,150.

Lot #622, an 1841 N-1 Cent, an R-5, in MS65 RB [PCGS], went even higher at $31,050.

Lot #633, an 1842 N-2 Cent, an R-1, in MS65 RB [PCGS], brought a mind-blowing $71,875.

Lot #634, an 1842 N-2 Cent, an R-1, in MS65 RD [PCGS], went for $29,900.

Lot #638, an 1842 N-6 Cent, an R-1, in MS65 RB [PCGS], brought $39,100.

Lot #672, an 1844/81 N-2 Cent, an R-2, in MS64 RB [PCGS], brought $33,350.

Lot #830, an 1848 N-2 Cent, an R-2, in MS67 BN [PCGS], demonstrated that a fabulous, mega-gem non-RD coin was just nowhere near as sought after as a RD one on this day, bringing “only” $20,700.

Lot #851, an 1848 N-10 Cent, an R-3, in MS65 RD [PCGS], brought $25,300.

Lot #863, a knockout 1848 N-19 Cent, considered to be Low R-6, in PF65 RB [PCGS], brought $42,550.

Lot #941, an 1849 N-18 Cent, another R-6, in PF65 RB [PCGS], went for $35,650.

I could keep going, but I think you get the idea . . .

And, just like at the Holmes sale the night before, the large auction room was packed, and there were a wide variety of successful bidders. With the evening perhaps best summarized by this exchange during the auction:

After lot #847, a common 1848 large cent but in MS65 RD [PCGS], sold for $29,900, Ira Goldberg exclaimed from the podium, “That’s a record for that coin!” To which someone yelled back, “They’re ALL records!” to laughter from the audience. And they were.

So, what does it all mean? Again, demand for great, fresh coins was simply stunning.

And while this may have little impact on the ‘regular’ market, sometimes the dispersal of a great collection like this can create new collectors who had not previously participated in the category. So it will be interesting for me to see if if tonight’s enthusiasm will carry over into future auction and bourse activity of these late date cents.

In the meantime, I will be ramping up for the ‘regular’ Goldberg Long Beach Auction session, which you can read about right here tomorrow.

Until then –

September 8th: A Return to Normalcy

It was a quick turn-around on Tuesday, with Monday’s session running until the amazingly late hour of 3:27 AM, and Tuesday’s starting back up just a few hours later with the ‘regular’ Pre-Long Beach sale at 10 AM.

And with it came a return to ‘numismatic normalcy’.

First, it was a fine catalog, but included more the sort of material one might expect to find in any medium-large auction or on the bourse floor at a larger show. Within which we found a dozen or so things we wanted, widely spaced through the day (of course).

And as I sat there, the difference in the feel of the room was pronounced, with the frenzied activity of the last couple of days replaced with normal bidding activity (i.e. people having actual limits to what they would spend on a particular coin). Still, I thought the prices were generally pretty strong – at least on the things we wanted to buy – and we were only able to get a few of the lots we targeted.

So after hanging around for another several hours (and getting really sick of being in that room), I finally said ‘no mas’, left a few bids on the later items, packed up my stuff and headed down the road to Long Beach with Lee J. Bellisario, a long time dealer and a legend (though he would deny it!) in the business.

I always enjoy talking to “Lee J.” since he was the auction director at New England Rare Coin Galleries beginning in the mid 1970’s, just as your author was in Junior High in the area and really getting interested in coins. And, since they were ‘local’, I would hang out there viewing lots in their upcoming sales (even though they knew I couldn’t afford to buy most of them) and scribbling notes like crazy in my NERCG catalogs (all of which I still have, of course).

So it was pretty cool to be sitting in the car with Lee as he told me what it was like inside that firm, how he was hired as the 7th employee, how they grew to 180 people at their peak, etc. It was a cool trip down memory lane, though from a different perspective, and including a lot of stuff I have never heard before.

Which made the ride go faster than usual, as we zipped down to LB just in time to check in, drop my bags and run over to Heritage lot viewing so I could start the auction process all over again.

It will be more of the same Wednesday AM, followed by dealer set-up at 2 PM, at which time I will hand the keyboard over to John (since he will be arriving in LB tomorrow) and let him handle the RR duties for the rest of the week.

And with that I’m going to sign off, and say thanks for reading the Road Report.

DW

September 9th: It’s a Set-Up!

Finally, after my (almost) completely non-numismatic long-weekend (offset by a medium-sized case of ‘I missed an auction’ withdrawal), I hopped on a trans-continental flight this morning and headed as fast as I could to the Long Beach Convention Center.

Arriving at just about noon, I dropped my stuff at the hotel, dashed over to Heritage lot viewing, scooped up my badge, apologized to Dave for missing all the fun in Beverly Hills and then hit the bourse floor running here on Dealer Set-Up day.

But we didn’t need to run very far, as our first stop was to pick up a couple of wild coins we had been offered earlier this week, squint into a loupe looking at the surfaces and spend the 11 seconds necessary to say “It’s a deal!”.

We also found a few nice gold coins on the floor, 2 other colonials, and bought a really cool Pillar Dollar from an unlikely source.

During which it became clear to me just how subdued the room seemed this time around, with many of the regular dealer attendees not present. Some guys were evidently spent (literally) after the recent auctions, while others were on ‘show overload’ after the ANA and PCGS Vegas show. I guess.

But the people who are here were generally upbeat, and of course very interested to dissect all of the weekend’s auction results in Beverly Hills. Which included a long conversation with one of the guys who bought a lot of the big coins in those sessions in which he described what he thought of specific coins, what his presale estimates were, which coins he stretched to buy and which ones he got for well less than his max bid(!). Fascinating stuff.

Somewhere in there we managed to set up our own inventory, sold just a couple coins, submitted some very cool stuff for grading, ate a bag of mixed nuts, split a smallish deal with a foreign coin dealer and then called it a day.

Just in time to go head out for a nice dinner with some dealer friends at one of our favorite local restaurants, skip dessert, walk back to the hotel, start this blog, answer email and then collapse face first into the bed after a wonderful 22.5 hour day.

Tomorrow the show and the HA auctions begin in earnest, which ought to provide some excellent content for tomorrow’s RR. I hope.

Boy, it’s good to be back!

JA

September 10th: Show Time!

Good morning everyone and welcome to the Thursday edition of the RR.

And it began early, as I woke up with a huge headache at about 3:30 AM, took a bunch of Advil, finished the Wednesday blog, eventually got my act together and headed over to the convention center at 8.

Which gave us ample time to get all of our inventory, grading and paperwork in shape and then walk the floor looking for things to buy before the public would, theoretically, come streaming in at 10. Often, though, we get so busy doing things in the morning that we lose track of time, and don’t realize that the show is actually open to the public until a bunch of people come walking down the main aisle from the entrance.

Which they did on this day in surprisingly impressive numbers. In total, and in the opinion of a lot of the dealers we talked to, there seemed to be a lot more public here than there was at the ANA last month. Which although it is not saying much, was still really good.

And business was active throughout the room, as it was for us, as we sold a bunch of coins and bought a lot too, including quite a few colonials, some foreign, and a lot of federal.

It was also an unusual day in that some very cool stuff just happened to walk up to the table, not all of it for sale, unfortunately, but still fun to see – including some u-n-b-e-l-i-e-v-a-b-l-e pop top federal stuff that one of our customers owns, that we did not know he owns, and that no one has seen before.

We also got all of our PCGS grading submissions back, fast, with pretty decent results overall.

In fact, the only really negative thing that happened (other than the headache), was the two ridiculous fire drills we had looking for missing coins that I was positive we brought, but couldn’t find (despite turning the back case upside down and making a huge mess), and which turned out to have been at PCGS the entire time. Phew.

Which in total meant that it was a very good day here at the show, culminating with the evening’s Heritage auction at 6 (in which we bought a couple of coins and saw some of our others sell nicely), then headed off to dinner at a restaurant we’d never been to before with a dealer friend.

Tomorrow some world auctions are on the agenda, along with, we hope, more collector traffic, more selling and, if all goes according to plan, buying at least a couple more cool things on the floor.

And if we do, you can read about right here, tomorrow, in Friday’s Road Report.

September 11th: Good Buy, but not Good Bye

Do you remember how yesterday we said we hoped to buy a couple more things on the floor?

Well, we did – a couple of boxes of NEWPs. Including some raw coins, some slabbed, some nice, wholesome and affordable, and others that are spectacularly high end.

In other words, it was an impressively good haul – maybe the most in both unit count and dollars we’ve ever bought at a Long Beach show.

Now, we did sell a few of them within just a couple of hours (including the most beautiful pair of Capped Bust Dimes either of us had seen in a while), but we still have plenty of cool coins for the next EB, many other things running through the grading services, a slew of things that are en route to the photographer, and a few coins on want lists that we already shipped out to customers.

Speaking of which, if you have not given us a want list, you might want to think about it. Things can happen fast at shows, and we need to make decisions about what to buy pretty quickly. If we know we have a customer interested in a particular coin, we’ll try very hard to seek out a nice one and buy it before it gets away. Equally, some of the coins we buy at shows end up selling a few hours later on the bourse floor. But if we know we have a customer for a coin, we’ll put it aside in the back case and make sure to bring it back with us.

Anyway, back to our regularly scheduled discussion of the LB NEWPs, the evaluating, buying, categorizing, submitting, boxing and mailing of which took most of the day on Friday, leaving me just enough time to consider (and re-consider) buying something for yours truly, eat a chef salad, and zip in and out of HA auctions whenever a lot we had targeted came up.

The last of which was at about 6:30 PM, during which I bought one coin and then went straight to dinner, which tonight was small and included no alcoholic beverages of any kind (since I feel like I have already exceeded September’s quota, and it’s only the 11th).

Tomorrow I’m not sure what to expect, but if more of the right kinds of coins happen to show up, we’re going to buy them. And when people stop by the table, we should still have plenty of cool stuff to see (provided you get here before the last box gets shipped home).

Whatever happens, you’ll be able to read about it on our next RR, which will be posted either from the airport Saturday evening, or from my couch at home on Sunday night.

So stay tuned!

September 12th: Leaving, On a Jet Plane

Here I am, back in the same airport terminal I visited just a few weeks ago after the ANA, and little has changed: The restaurant options are still lousy, and the security guy on the Segway is still roaring through the terminal at about 35 mph. That’s not an exaggeration – and I would not be at all surprised to see a newsflash on CNN someday soon about this guy running over some elderly passenger who was absent mindedly walking to their gate and not realizing they were in the high speed lane.

Anyway, I am out of harms way, and I’ve got plenty of time before my flight, so I figured I’d conclude our LB RR right now, and not keep everyone waiting until tomorrow night. And so, without further ado, let’s get started:

I got to the show at precisely 9 AM on Saturday, ready to efficiently zip right into the bourse (per the posted dealer hours) and get some work done. But much to my surprise the door was still locked up tight, so I (and the hundred other dealers who had by then gathered in the cramped downstairs lobby) got to stand around and wait, a frequent activity on the coin circuit (as has been well documented on this site through the years), and one of the most annoying things about this job.

Though at least in this case we got to watch the women filtering into the cosmetics convention next door, including some lady wearing the tightest black pants your author has ever seen at a coin show.

At which time the bourse door finally flung open and we all poured in.

As my first order of business, I figured I’d race down to the post office and get some boxes before they ran out (which happens sometimes), and then mail my stuff early before a giant line formed, since they were so astonishingly slow here yesterday and, trust me, you do not want to be behind someone who has pushed a big cart of outgoing Registered Mail packages up to the counter.

But it turns out the PO wasn’t even open yet, so I took my empty box, grabbed breakfast and then sat around packing some coins up for photography and shooting the bull with another dealer for about 30 minutes. Eventually migrating back to his table where he sold me one nice coin.

Then it was back to the Post Office to mail the aforementioned box, which took about 45 minutes, but even a slow post office line is better than none, which, according to the sign posted on the counter, is what we will have at the next LB show. That’s right – in a cost-cutting move, the USPS will not be coming here anymore. Not sure how we’ll cope with that going forward, but we better think of something.

After which I walked concentric circles around the bourse floor looking for interesting things, and finding a few pretty neat colonials in different dealer cases. But we couldn’t agree on prices and I didn’t buy either one, which was fine. In fact, I never did find anything else I had to have, so the total number of acquisitions for the day was just the one not-too-exciting early morning NEWP.

Though the afternoon brought a different kind of excitement, as Ron Gillio (General Chairman of the LB show) announced that a thief had been caught among us, was currently being questioned and would later be escorted down the main aisle and off to the police station. And later they did haul him out to some scattered applause from the dealer community, all of whom were trying to get a look at the guy to see if he had been at their table, too (an important thing, since the guy apparently had coins stolen from 9 different dealers in his possession when caught!). He didn’t look familiar to me, though (which was a relief).

With that excitement past, we had some decent sales, mostly of moderately priced items, with the last invoice written at about 15 minutes before the 5 PM closing.

Which was an extremely nice way to end a show that turned out to be good on the selling side and, despite Saturday’s slim pickings, absolutely epic on the buying side. Which means we will be very busy sorting things out on Monday and compiling the next EB for Tuesday.

And then gearing up for the new Whitman Philadelphia Show and the Bowers and Stack’s auctions, from where our next EB will be posted in an alarmingly soon 10 days(!) from now.

All of which suggests that I need to get some serious rest now, and so I’ll be signing off from LB, September 2009.

The End