February 13-16, 2008: The Long Beach Coin & Currency Expo

Day 1:

This week hasn’t gone exactly as we drew it up.

Life intervened as they say, and what was intended to be 8 days out here in Beverly Hills and Long Beach for Dave and me has turned into 4 days for your author, as I will be going solo this time around.

Which I began on Wednesday at 3:45 AM, rising for my early flight to the coast, spending an enjoyable 4 hours watching the Roger Clemens hearings on my in-flight TV, heading straight to the convention center upon arrival and then spending a solid 5 hours viewing lots, submitting a gazillion coins for grading, looking for things to buy and selling a few coins.

Overall, I was moderately successful on most every single count:

I found the Heritage lots pretty interesting, especially the Husak Large Cents which offered surprisingly (sort of – since I had seen most of them before in various preview displays over the past year) varied quality levels. Some exceptional; some not so much. I was also surprised to see some fairly heady coins in the group which were in ANACs net slabs as they evidently were considered unslabbable by PCGS (and presumably NGC as well).

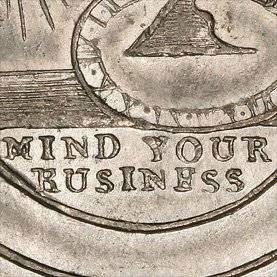

My efforts to buy were met with a lot of not buying very much, as I didn’t see too many coins I wanted. I did make a few mental notes and may go back today and pick them up, but normally if I don’t buy something instantly, it means I was not inspired. I did however pick up a copy of Eric Newman’s new Fugio book, which I am excited to crack open as soon as I have a spare few minutes here at the show.

As for sales, we did OK. I don’t have our usual mega-assortment with me this go round but I was pleased to sell a few medium sized coins and one big one despite being camped at the PCGS table for a while excitedly filling out submission forms during much of the afternoon.

That was it, other than dinner, which was a nice get-together with some dealer friends at a restaurant well off the beaten track 10 blocks or so from the convention center. Which was good, since the walk there and back allowed me to get some actual fresh air for the first time in 24 hours.

It was a fairly early evening though, as I wanted to get back to the hotel and carefully plan for Heritage’s Tokens and Medals auction which will start bright and early on Thursday morning. And I intend to be ready for it.

Day 2:

Other than the fact that I felt like I had contracted a tropical illness overnight, Thursday started extremely well.

I was up at 6 AM enthusiastically writing our blog, then headed off to the convention center at about 8:30 to get ready for the Heritage Tokens & Medals session scheduled to start an hour later. And then I started feeling pretty green (as in not that great), and briefly considered going back to the hotel and sleeping for 14 hours. But knowing that this would preclude me from having some entertaining experiences and then writing a about them in this blog (and thus disappointing our readers), I decided to numismatically tough it out. So I did.

I went to the Heritage table and re-looked at a number of the lots, finalized the few I reeaaaally wanted and then tried to figure out what time they’d go off. As an aside, that’s a fun sport – when you try to structure your day around the pace of an auction based on a guesstimate of the number of lots they’ll crank out per hour (aided by the gigantic current auction lot projection Heritage beams onto the wall of the bourse floor at such an angle that it cannot be seen from my table).

Anyway, my calculations suggested I had about an hour and a half to walk the floor, find coins to buy, submit all the rest of our show walk-throughs at the services, work the table and then, leisurely like, head upstairs for bidding.

And that worked great, as (unlike yesterday) I actually found quite a few interesting coins in many series, buying about 15 different things from all sorts of different dealers, got a large cramp in my hand from writing out a few more PCGS submission forms and then got back to the table in time to actually sell a couple of coins.

At which time I took a look at the auction progress and saw that they were, after all that time, still stuck on lot 29. Huh? Figuring the projection must be wrong, I went up to the auction room in person and found a bunch of people milling about. Not good. Apparently some sort of computer glitch had derailed the auction and they were about an hour and a half behind. Which meant I had time (plenty of it) to head downstairs for more action behind the table.

Anyway, that worked out OK, the auction eventually resumed and I ended up buying what I wanted.

Overall, the day went well on the buy and sell side, our first indication of grades was perfectly serviceable, and I got to see some west coast collector friends we haven’t seen in months and share some numismatic research and some fun stories. Memorable among them was a friend relating his experience meeting a very prominent, old-school (and highly secretive) collector some time ago. Our friend thought it would be a good idea to ask the collector if he might consider exhibiting his coins at a show some time and sharing them with others, to which the collector reacted as though “he suddenly smelled #@&*“.

I got a kick out of that story, and I think we can safely say that that collection will not be exhibited anytime soon. A shame, but that seems to be the prevailing view among some collectors.

That was it – I did not attend the evening Heritage evening session, instead saving my bullets for the auctions on Friday including what figures to be an epic and dramatic sale of the Husak collection at 5 PM.

I look forward to seeing what some of the big coins go for, and reporting about it right here in this space tomorrow.

Day 3:

Do you know how many coins we sold today? Hold that thought.

I got a little bit of an early start on Friday, waking up at 3 AM (jet lag maybe?) and thus carving out a few bonus hours before breakfast, perfect for blog-writing, lot reviewing, paperwork, etc. Imagine how productive you could be if you didn’t sleep at all.

Anyway, with that behind me, I was off to the convention center at about 8:30 and ready to tackle what figured to be an extremely long and tiring day.

It was sort of more auctions, and more grading submissions, and more buying and more retailing all leading up to the major event of the day, the sale of Walter Husak’s Large Cent collection at 5 PM. So let’s get right to that.

The crowd started to file in at about 4:30, almost entirely filling a pretty good sized room. And everyone was there, from all of the usual suspects, and major dealers, and minor dealers, lots of collectors, Mr. Husak, his family, many interested observers and media members and a bunch of people I’ve never seen before in my life.

Greg Rohan kicked the night off with some introductory words about the collection, how great it was, etc, etc. before turning the mike over to Mr. Husak himself for a few brief words of thanks and finally to auctioneer Sam Foose who first gave that long explanation about the rules of bidding (which always reminds me of the safety presentation on a flight – you know, the same exact info each time, but always presented a little bit differently and never seeming quite as crisp and well-rehearsed as it could be) and then called the first lot of the evening – and it wasn’t even in the catalog. Actually, it WAS the catalog.

A special, hardcover version of the catalog, that is, No. 1 of just 100 to be printed, with all proceeds going to EAC (and no buyers’ fee!). Foose said he’d pay $500 for it and opened the lot at that price, then watched as it quickly ratcheted up to 3 or 4K in a matter of a minute or two.

At that precise moment I turned to John Kraljevich seated next to me and made some sort of extremely witty remark about how this did not bode well for reasonable prices during the evening (not that any of us expected them to be).

And they weren’t.

The Chain and Wreath Cents went very strong, especially in light of the quality level, which was very good but not spectacular for the issues or for the grades assigned. Didn’t matter though, bidding was strong, frequent and widespread, coming from all over the room and from collectors and dealers alike.

Notably, the bids were hammering in most every case to bidders in the room, unlike the rest of Heritage’s auctions where the lots seem to yield to internet, phone and Ebay bidders about half the time (or more).

As we were watching the proceedings unfold, John K and I had a few interesting observations and side bets:

First, we tried to figure out how many lots would progress before both of us thought the winning bidder actually got a good deal, meaning that with this sort of crowd, in such a well publicized auction, most everything was going to go sky high and the odds of a coin slipping through the cracks and selling for less than it was worth was about nil. And that’s kind of how it played out, with our view being that lot #2040 was the first “good deal” in the sale. Unfortunately, it didn’t hammer to either one of us.

Second, we tried to guess how many lots into the sale it would be before Husak broke even on the collection. JK thought it would be after the 1794s concluded (meaning all the ’95s and beyond represented pure profit), while I though it would be even earlier than that.

Third, we tried to guess how much some of the more famous coins would sell for, with each of us writing our guesstimate in the catalog and then seeing who was smarter. And it was JK, in every case guessing slightly higher than I did (but still well below the actual hammer prices). But he was closer than me.

Fourth, we spent most of the night cracking each other up with sophomoric jokes not unlike what you might have expected from two kids in high school. Maybe we were just tired or something, but it was pretty entertaining.

Anyway, we thought a few results were notable:

Lot #2002, a 1793 Chain AMERICA Cent in slightly funky looking MS62 [PCGS] opened at 90K and landed at 220K – about a 100K more than I was expecting.

Lot #2014, the fantastic 1793 Liberty Cap Cent in AU55 [PCGS] (and pedigreed to 1867) was sure to go big, and it did, opening at $150,000 and hammering at $550,000 to a Heritage rep who, if I understood the bidder number correctly, was representing someone who was in the room bidding by himself on other lots. And that was a lot of dough – the most, in fact, ever spent on a US copper coin (I think). But it sure is a cool coin.

Lot #2019, a mint state 1794 Head of ’93 Cent opened at $22,000 and hammered for $220,000. Anytime a coin sells for 10 times the opening bid, you figure there was interest in it. But it was only one of many coins that saw a similar bidding trajectory – and it was only one of many 1794’s to hammer for $50,000+.

Lot #2035, the finest known 1794 ‘Wheel Spoke’ variety in VF35 [PCGS] opened at $8,000 and hammered for an 11 times+ multiple $90,000. Gosh.

Lot #2047, a 1794 Cent in MS65 RB [PCGS] ex-St. Oswald Collection (the first of many superb type examples in the Husak Collection) sailed well past $100,000, landing at $130,000 hammer. But that would seem cheap a few minutes later.

Lot #2050, the finest known 1794 ‘Starred Reverse’ Cent (and one of the three sexiest coins in the sale) hammered for another $550,000 to the guy we all knew was going to buy it. It was a collector/dealer from New Jersey at the end, the same guy who bought the finest known Strawberry Leaf Cent a few years earlier.

Lot #2066, the finest known 1794 ‘Missing Fraction Bar’ opened at $40,000, landed at $130,000, which seemed to JK and me to be the next good deal in the sale.

Lot #2069, the second and finest St. Oswald cent in MS67 RB [PCGS] was the definitive type coin in this run and the bidding reflected it, as it opened at $20,000 and sold for $425,000(!). I knew that would be a popular item, but I never, ever imagined a price of that magnitude.

And so it went, with most of the 1794’s and many of the later dates going strong, often opening at what seemed like low numbers and selling for 2 to 10 times as much (and many of us thinking the large cents in our own inventories were suddenly way too cheap).

But I was waiting for one special coin to come:

Lot #2192, the 1799 ‘Abbey Cent’ in XF45 [PCGS] was of particular interest to me as I dreamed of owning it at one time. But it wouldn’t be this evening, as I watched it open at $42,500 and eventually hammer to Colonel Steve Ellsworth for a lower-than-I-might-have-expected $140,000. Maybe I should have stuck my hand in the air on that one.

But there was one other notable result I skipped over:

Lot #2162, the 1798 ‘First Hair’ in XF40 [PCGS], which opened and closed at $2,900 and was thus the first coin that failed to meet reserve in the session. That was interesting, as some of the scuttlebutt before the sale (totally unfounded as it turned out) was that a lot of the coins would be reserved or ‘protected’ at sky high levels and would go unsold. I guess that wasn’t true.

Anyway, the sale was epic overall, bringing more money than most of the optimistic estimates, and causing Mr. Husak’s wife to wear an enormous involuntary grin throughout the whole event. And can you blame her?

And then Heritage hosted a deluxe dinner afterward which I skipped out on, coming back to the hotel, collapsing for an hour or so and then writing this coin blog instead.

Oh, and the answer was ‘two’.

Day 4:

True to form, Saturday at Long Beach evidenced all 11 of our standard final-day-of-the-show activities:

- Having a customer ask for a specific coin which you had on display starting on Wednesday all the way through until about 20 minutes earlier, at which you had boxed it up and delivered it to the post office for shipping home. Drat.

- Wading through a sort of pseudo-flea market environment in parts of the room, with big crowds poring through jewelry and other non-numismatic hoo-ha.

- Going to pick up your very last grading submission from the services and being told that “It had to go back to the office” (based on it being some unusual or esoteric colonial or world coin that they couldn’t grade on the premises). So you can’t have it here.

- Listening to all the same dealers complaining about how they never sell anything on Saturday, but are contractually obligated to sit there all day or risk losing their table position and who do not seem to be very happy about it.

- Entering the numismatic ‘Danger Zone’ – that time during midday where you get bored, wander the floor aimlessly and become tempted to buy weird things you absolutely, positively and for sure do not need.

- Packing up everything carefully, yet almost inevitably finding one last coin hidden under some refuse mere inches (or seconds) from having been thrown out or lost.

- Meeting a lot of beginner collectors who ask materially different questions than the experienced guys who show up earlier in the week. The most common of which is “Is that real gold?”

- Standing in line at the post office for 45 minutes behind someone sending 9 registered packages (and usually needing some new sort of insurance or special service which the postal employees have never heard of, and cannot figure out how to ring in).

- Eating a delicious ball-park style pretzel with mustard on it, a lot of which gets on your shirt.

- Finding one last good coin to buy as your heading out the door, the numismatic equivalent of sinking a long putt on 18.

- Get away dinner at the Hyatt where there is a waiter who remembers exactly what I ordered the last time I saw him in September. Seriously. Heck, I don’t have the slightest idea what I ordered in September, but it must have been one extremely memorable entree.

And the Big Finish:

Hanging out at the airport amidst what always seems to be some kind of loud college field trip, finally getting on the red-eye, not sleeping for even one single solitary moment of the 5 hour, cross-country flight, arriving in New England to 25 degree weather at 5:30 AM, getting home, learning from wife that at least one child has been up all night sick, finally checking my email a few hours later and having at least one which says something to the effect of: “Where the heck is your Saturday blog – too lazy to post one?”

And the answer to that is it is right here, and no I am not.